How to balance the holiday season with your business’ bottom line.

Depending on your industry – and area of focus – the holiday season can be slow for business. In fact, November to January might bring with it a looming sense of doom, not just related to shorter days and cooler weather, but instead, about your business’ bottom line.

In this article, we take a look at the holiday slowdown that impacts some businesses around this time of year, and some strategies for combatting any potential fiscal consequences it may have.

What is the ‘holiday slowdown’?

As many professionals know, this phenomenon happens when businesses or industries experience a decrease in activity or a slowdown in operations during the holiday season which can make an already tight time of year even more nerve-wracking.

Of course, not all industries are impacted, some sectors thrive during the holiday season. These include:

- Retail and consumer goods businesses.

- E-commerce.

- Hospitality, travel, and tourism.

- Subscription-based services that bill annually, starting in January.

Some of the industries most affected by the holiday slowdown season are:

- Service industries that are not directly related to seasonal activities.

- B2B businesses.

- Retail businesses that cannot offer online shopping alternatives.

What is the culprit behind this slowdown?

There are a lot of reasons your business might slowdown during the holiday season. Some that might be impacting your business include:

- Changing consumer priorities.

- Employee vacations.

- Business closures.

- Budget constraints for both your business’ spending and customer spending.

For these reasons, you might find your suppliers take longer to deliver, your clients and contacts don’t return calls or emails, and, altogether, things are just harder to get done. If you’re trying to accomplish work as normal during the holiday season, it might feel like the rest of the world is plotting against you.

There are strategies for combating the slowdown.

Businesses often need to adapt their strategies to navigate the holiday slowdown. Having a plan for this season can often make the difference between starting the new year off strong, or in a deficit. Depending on your industry, there are many tactics worth considering:

- The launch of holiday-specific promotions, discounts, and other deals to incentivize customer’s purchasing decision.

- Developing campaigns to encourage the sale of pre-paid gift cards and certificates as holiday presents.

- Investing in experimental marketing tactics to increase community engagement and local brand awareness.

Of course, depending on what your business specializes in , these might not be viable options.

Cutting costs is more effective than spending money.

There is a lot of advice out there that will tell you to put money and time into marketing campaigns, revamped customer service training, new product or service offerings, and other investments to survive the holiday slowdown season.

In general, spending money to make money makes sense. However sometimes it’s just another added worry during an already stressful season, and it’s not guaranteed to make the slowdown period any more lucrative. Having a plan to ensure your budget isn’t overextended during the holiday slowdown is the best tool available to guarantee a successful holiday season, and an even better new year.

What does this “plan” look like?

- Developing a comprehensive holiday business plan that includes sales forecasts and contingency efforts.

- Analyzing past holiday seasons to identify trends and areas for improvement.

- Managing inventory levels effectively to prevent overstocking or stockouts.

- Ensuring you’re not overspending on any essential business expenses all year long.

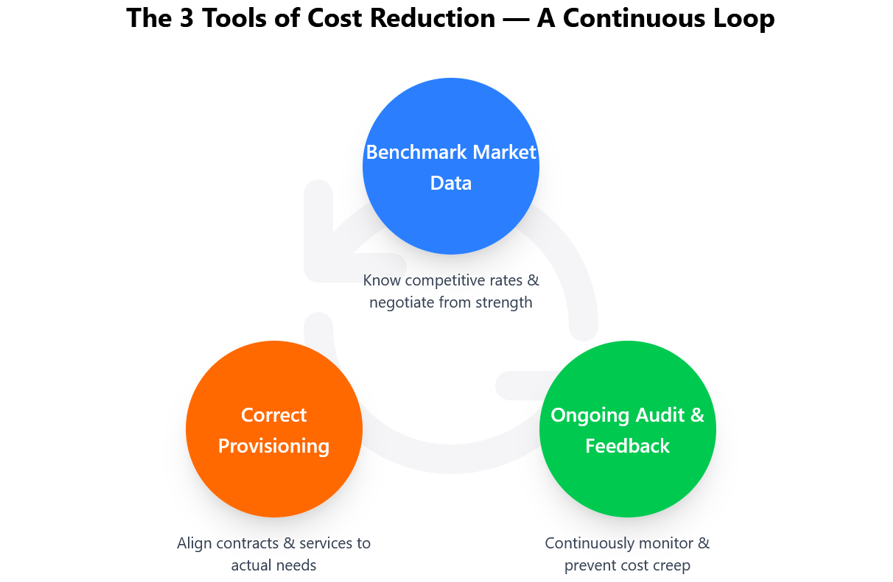

We’ve found that it’s not uncommon for businesses to be overspending on expenses like telecom, payment processing fees, and waste disposal by around 25-30%. Maybe that’s not a huge problem during your peak season, but during a holiday slowdown, that could pose some real consequences. The best thing your business can do to survive slow periods , is make sure all your costs are optimized, all the time.

In conclusion…

Depending on your industry, holiday slowdowns may become unavoidable. While there’s lots of advice out there encouraging you to spend money on shiny new initiatives or campaigns, one of the best things you can do is look for ways to ensure you’re not overspending throughout the entire year.

This past weekend, I had the chance to hit the sand at the 15th Annual Ranse Classic in beautiful Lido Key Beach — an incredible weekend filled with competition, community, and cause.

This past weekend, I had the chance to hit the sand at the 15th Annual Ranse Classic in beautiful Lido Key Beach — an incredible weekend filled with competition, community, and cause.